This journal entry should be recorded monthly until the revenue for the entire year has been properly recognized. This is because according to the revenue recognition principle, revenue should be recognized in the same period in which goods or services are provided. Then, on February 28th, when you receive the cash, you credit accounts receivable to decrease its value while debiting the cash account to show that you have received the cash.

- Since the actual goods or services haven’t yet been provided, they are considered liabilities, according to Accountingverse.

- First, since you have received cash from your clients, it appears as part of the cash and cash equivalents, which is an asset.

- Accrued revenue pertains to income that has been earned by providing goods or services, but payment has yet to be received from the customer.

- So, as the seller delivers on the performance promise, the unearned revenue is converted into earned revenue.

Reporting Requirements for Unearned Revenue

Baremetrics integrates directly with your payment processor, so information about your customers is automatically piped into the Baremetrics dashboards. Basically, ASC 606 stipulates that you recognize internally and for tax purposes revenue as you perform the obligations of your sales contract. To determine when you should recognize revenue, the Financial Accounting Standards Board (FASB) and International Accounting Standards Board https://abireg.ru/n_63448.html (IASB) presented and brought into force ASC 606. On a balance sheet, assets must always equal equity plus liabilities. It is a priority for CBC to create products that are accessible to all in Canada including people with visual, hearing, motor and cognitive challenges. While ATCO claimed it had paid for the equivalent of 56,356 nights, the statement says the real number was 35,805, with the remaining 20,551 being non-revenue rooms.

The Best Accounting Software for Consultants

Accrual accounting is a method of financial reporting in which transactions are recorded when they are incurred, not when the cash is exchanged. This method allows for a more accurate reflection of a company’s financial activities, providing a better understanding of the company’s overall financial health. Perhaps the biggest impact would be inaccurate financial statements, with revenue totals overstated in the month when the prepayment is received, and understated in all subsequent months. Because services have been delivered for January, you can recognize the amount of revenue that should be allocated to January, which is $1,000. The balance of the $12,000 payment remains in unearned revenue until goods and/or services have been delivered for February. Since unearned revenue is cash received, it shows as a positive number in the operating activities part of the cash flow statement.

Compliance with GAAP Rules

It must be recorded in the accounts books of the seller and buyer as well. It is recorded as soon as the transaction takes place and recognized as a current liability on the balance sheet of the seller. Deferred revenue is classified as a liability, in part, to make sure your financial records don’t overstate the value of your business. A SaaS (software as a service) business that collects an annual subscription fee up front hasn’t done the hard work of retaining that business all year round. Classifying that upfront subscription revenue as “deferred” helps keep businesses honest about how much they’re really worth.

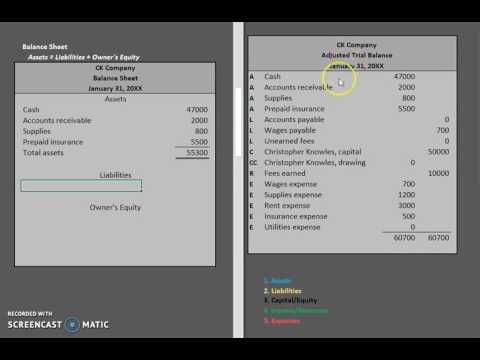

On a balance sheet, the „assets“ side must always equal the „equity plus liabilities“ side. Hence, you record prepaid revenue as an equal decrease in unearned revenue (liability account) and increase in revenue (asset account). This means you’ll debit the unearned revenue account by $2,000 and http://bcferro.com.ua/ctg/0/30/?page=42 credit the revenue account by $2,000. You’ll see an example of the two journal entries your business will need to create below when recording unearned revenue. Taking the previous example from above, Beeker’s Mystery Boxes will record its transactions with James in their accounting journals.

Resources for Your Growing Business

- With each month, a business can record the performance bonuses as a liability on their balance sheet to accurately record what they’ll need to pay out at the end of the period.

- If you are unfamiliar with ASC 606, I strongly recommend you read the related article for now and take the time to go over the entire document with your accountant at some point.

- Using journal entries, accountants document the transactions involving unearned revenue in an organized manner.

- The second journal entry is in compliance with the GAAP rules and accrual accounting principles though.

Investors and creditors often scrutinize a company’s financial statements when making decisions. If a company accurately accounts for its unearned revenue, it can provide a more realistic picture of its financial health and performance. This can influence investment decisions and the company’s ability to secure credit or financing.

The Ascent, a Motley Fool service, does not cover all offers on the market. Baremetrics provides you with all the revenue metrics you need to track. Integrating this innovative tool can make financial analysis seamless for your SaaS company, and you can start a free trial today. If you are unfamiliar with ASC 606, I strongly recommend you read the related article for now and take the time to go over the entire document with your accountant at some point. Read testimonials and reviews from our customers who have achieved their goals with Baremetrics. Discover how businesses like yours are using Baremetrics to drive growth and success.

In the second instance, the company inflated the cost of accommodation at a construction site. The statement says ATCO overstated the number of rooms it was paying https://zxtunes.com/author.php?id=802&md=3 for through its purchase of a work camp at Beaver River in east-central Alberta. These two terms are used to report different accumulations of numbers.

When dealing with unearned revenue, there can be instances of overstated or understated amounts. Correcting these discrepancies is essential for presenting accurate financial statements. By keeping these industry-specific considerations in mind, businesses can better understand the dynamics of unearned revenue and its impact on financial reporting. In this section, we will explore certain industry-specific considerations for unearned revenue, diving deeper into service and subscription models as well as publishing and prepaid services. Accurately recording your unearned revenue will help keep your books straight and provide valuable insights into the health of your business. Improper revenue reporting may not affect very small businesses, but it can definitely affect larger businesses.