Generally Accepted Accounting Practice UK Wikipedia

The Financial Reporting Standard for Smaller Entities will continue to be available for those that qualify to use it and will remain fundamentally unaltered for the time being. A listing of the superseded standards and statements which have been withdrawn and replaced by FRS 100 to FRS 105. Impact assessments and feedback https://www.accountingcoaching.online/accounting-careers/ statements have been issued alongside the relevant standard or amendment to a standard. On 13 December 2018 the FRC issued a suite of staff factsheets on aspects of FRS 102, including the 2017 triennial review. The factsheets are intended to assist stakeholders by highlighting certain requirements of FRS 102.

Let’s talk about… finance & accounting apprenticeships

FRS 102 permits reduced disclosures for the individual company financial statements of qualifying entities within a group. The standard also contains separate, more limited, disclosure requirements for small entities. As well as providing direct access to a world-class collection of books, journals and electronic resources, the ICAEW Library can search various international databases on behalf of members, ACA students and other authorised users. Our specialist databases contain jurisdiction-specific information on accounting, tax and related topics. Self-Employed and Simple Start include free access for one user, Essentials for three users, Plus for five users and Advanced for 25 users.

ICAEW Communities

Information about accounting standards and other guidance effective for accounting periods beginning before 2015. FRS 102 The Financial Reporting Standard is the principal accounting standard in the UK financial reporting regime. Generally Accepted Accounting Practice in the UK (UK GAAP) is the body of accounting standards published by the UK’s Financial Reporting Council (FRC). In this section you can find summaries of the standards 36 synonyms of auditing and practical resources such as factsheets, FAQs, model accounts, and eBooks. It can lead to many different career paths, from becoming a certified public accountant (CPA) or financial analyst, to going into roles such as financial management, investment banking, or corporate strategy. You could be at the heart of financial decision-making, contributing to the financial health of organisations and influencing business growth.

FRS 104 Interim Financial Reporting

All accounting standards developed by the ASB from 1990 were issued as Financial Reporting Standards (FRSs). The Urgent Issues Task Force (UITF) was part of the previous standard-setting regime. It assisted the ASB by investigating areas where conflicting or unsatisfactory interpretations of accounting standards or Companies Act provisions existed, or had the potential to arise. The acronym GAAP stands for ‚Generally Accepted https://www.business-accounting.net/ Accounting Practice‘ — or, alternatively, ‘Generally Accepted Accounting Principles’ or ‘Generally Accepted Accounting Policies’. GAAP is a term used to describe the rules generally accepted as being applicable to accounting practices as laid down by standards, legislation or upheld by the accounting profession. The ICAEW Library has compiled this guide to help everyone to find the accounting standards they need.

Entry requirements

- A similar but not identical list of Recognised Supervisory Bodies (RSBs) may authorise their members to carry out company audits.

- UK incorporated groups with securities admitted to trading on a UK regulated market need to prepare accounts using UK-adopted international accounting standards for all financial years beginning on or after 1 January 2021.

- The principal legislation governing reporting in the UK is laid down in the Companies Act 2006, which incorporates the requirements of European law.

- Other changes impacting trade include improved estimates on transactions of second-hand ships, and new methods of approximating the import and export adjustments for ship repairs.

- Statements of Standard Accounting Practice (SSAPs) were the previous generation of accounting standards, prior to FRSs.

- An account records and displays all flows and stocks for a given aspect of economic life.

Candidates who hold degrees in accounting or related subjects may be exempt from certain papers. When evaluating British vs American accounting terms, organizations should also consider differences related to ownership structure, reporting requirements, and company law. These factors may influence the way financial information is reported, as well as the type of language used to describe it. Yes – in general, GAAP governs accounting in the United States, while IFRS governs accounting in Great Britain.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

IFRS Accounting Standards as adopted by the EU were incorporated into UK law, with effect from that date, by way of the IAS EU Exit Regulation.4 Powers under UK law to formally adopt IFRS Accounting Standards were reserved to the UK Government. These powers were delegated to the UK Endorsement Board in May 2021 through the International Accounting Standards (Delegation of Functions) (EU Exit) Regulations 2021. IFRS Sustainability Standards are developed to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs. IFRS Sustainability Disclosure Standards are developed by the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body within the IFRS Foundation. IFRS Accounting Standards are developed by the International Accounting Standards Board (IASB).

The changes also include improved methodology for calculating disbursements in the UK by foreign operators. The accounts are fully integrated but with a statistical discrepancy (known as the statistical adjustment), shown for each sector account. This reflects the difference between the sector net borrowing or lending from the capital account and the identified borrowing or lending in the financial accounts, which should theoretically be equal.

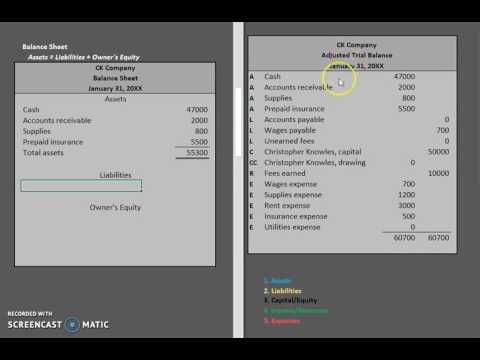

These are the main documents an accountant will need to complete a finance assessment. As noted above, SORPs provide guidance on the application of accounting standards to specific industries and sectors. The first SORPs were developed by the ASC; today the FRC recognises other bodies‘ power to develop SORPs. Whilst a number of SORPs are still in force, others have been withdrawn or superseded. The FRC recognizes the power of other bodies to create SORPs to guide the application and maintenance of accounting standards in specific sectors or industries. SORPs can be obtained from the appropriate bodies in the relevant industries or sectors.

FRS 100 sets out the financial reporting requirements for UK and Republic of Ireland entities. However, Sage 50 is much, much pricier than comparable small-business accounting software. While Sage’s features definitely justify the cost, it’s not an affordable solution for budget-conscious small businesses.